Why are Payday Loans so Expensive or Are They?

Let’s start with a statement that says, “Yes, payday loans can be considered as expensive”, but you must consider how you’re being forced to look at them. If you borrow $100,000 from a bank for 30 years, for a house, you’ll pay back over $230,000 which is a real interest rate of 130% (130,000 / 100,000) but lucky for the banks they get to use APR and show the loan at a 5% interest rate.

Let’s start with a statement that says, “Yes, payday loans can be considered as expensive”, but you must consider how you’re being forced to look at them. If you borrow $100,000 from a bank for 30 years, for a house, you’ll pay back over $230,000 which is a real interest rate of 130% (130,000 / 100,000) but lucky for the banks they get to use APR and show the loan at a 5% interest rate.

The Media & Politicians Love to Treat Payday Loans Like they are Evil

The media and politicians love to treat payday loans like the’re evil. The media writes stories on the worst situations that some people have experienced and the worst players in the business and believe me there are bad players in this business. No one would ever think that banks are evil or that they’re bad players in that business, right? Payday lending is an easy target for politicians because they take the stance that they’re protecting the consumer. That’s a grand and noble position to take as a politician but they’re wrong and the over regulation is driving up the cost of the loans for those they claim they’re trying to help.

Are Payday Loans Evil or too Expensive?

From my experience in this business, the average payday loan is currently about $25 to $30 per $100 borrowed. Yes, I consider that to be a little expensive and any time we provide a loan we gladly and clearly make sure the borrower knows the cost and take care to warn them that these loans are for emergencies only and should’nt be used as a solution to a long term financial problem.

What is an APR and Why does it Not Work with Payday Loans?

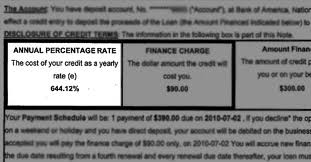

The law requires that any loan be shown in terms of an Annual Percentage Rate (APR) which is what the loan would cost if you kept paying interest on it for a year without repaying the principal back until a year was up. All payday lenders that I’ve ever worked with absolutely follow the law and provide the APR as required. However, classifying a loan that lasts on average two weeks on an annual basis is misleading at best but is it as misleading as getting to show a loan as 5% interest when in actuality ends up costing 130%? If you were to take out a payday loan for two weeks but only pay the interest on the loan every payday for a year then the APR would be exactly accurate. That is exactly the problem though, who takes out a two week loan and does not pay back any of the principle for a year and only pays the interest for that entire year?

To me $25 per $100 borrowed is actually 25% interest and I personally believe that payday lenders should be allowed to market their loans showing the real interest rate and banks should actually be forced to show the real interest rate of their loans and credit cards as well. Now, the media is correct when they say that most users of payday loans are lower income borrowers. Well, go figure, only the people that the banks won’t loan to and who are left with only one option, to get a loan in an emergency, are the ones that are inclined to use a payday loan service. When you borrow $100 and pay back $125, you don’t have to be a genius to know that your real interest was 25% (25 / 100).

Why Do Payday Loans Appear to be Expensive?

If you look at a two week loan in terms of APR then you will get a very high APR but if you look at it in an actual rate it’s 25% to 30%. Yes, to me that is expensive for a loan but the question was why is it so expensive and is it really?

When I ask, are they really that expensive? I was pondering if anyone has ever figured the APR that is being charged when you pay $2 to $3 just to get your own money out of an ATM? I then remembered that I used a loan calculator the other day which showed if I took out a $100,000 house loan for 30 years at 5% interest I’d end up paying back a total of $230,755.78. Hummm, if I borrow $100,000 and paid back over $230,000, that sure doesn’t sound like 5% interest to me, so is the 5% the APR? Yes, I believe it is, but that is the beauty of APR for banks, they get to show an interest rate of 5% when in all actuality you’re paying over 130% in interest. I guess, if the loan is large enough and the term is long enough and you don’t realize you’re paying over 130% in actual interest then it’s a better and more ethical loan, right? Wrong!

You’ve got to know that banks don’t want payday loans to exist and pressure politicians to over-regulate them and over-regulate them and over-regulate them which continues to add to the cost of payday loans and those regulations make sure the loan is portrayed to potential borrowers in the worst possible light to add to continue to add to the bad perception of the payday loan, which is just what the banks want. So, if you’re only allowed to use APR, which loan is going to look better to you, a two week loan or a thirty year loan? I’ve just showed you the answer to that!

Should Payday Loans be Made Illegal?

I’m sure there are many in the media that can sensationalize or find a bad payday loan or bad lender to write about and that there are politicians that can hop up on the stump and rail against the evils of many things but you can bet your last dollar that if they were living paycheck to paycheck and had an emergency and found that no bank would loan to them or that the bank would take two weeks to get them the loan that they needed right now, then each and every one of them would do just like millions of people just like you and I do and take out a payday loan to handle the emergency.

They’re NOT many people outside of the payday loan industry that see the benefit of the payday loan service. However, the millions of people that need and use short-term loans surely see the benefit. We all want access to money in an emergency, even those among us that have trouble making ends meet some times.

So, my answer is no, payday loans should not be illegal and in fact should get some of the regulations against them removed or lightened if they are being good lenders, not hiding fees and are following the law. Payday lenders provide a valuable service and should be forever allowed to provide loans to those that need them, when they need them.

Why do Payday Loans Cost What They Cost?

As you can imagine, payday lenders are dealing with loaning to people who for the most part live payday to payday and then have an emergency, like an auto break down and need to get the cash to fix the car so they can get to work and not lose their job. People in these types of emergency situations will gladly pay the 25% to 30% to get the money they need because that’s their only option and they must have the money. Is that a reason to charge that person so much just because they have an emergency? No, that reason itself is not a reason to charge so much and it’s actually not the reason that lenders charge what they charge. Now, you have to go back to who lenders are loaning too; most borrowers live paycheck to paycheck and when the loan comes due many borrowers make the decision not to repay the loan. Now, a lender will not be loaning for very long if even 20% of borrowers fail to pay back their loan. Yes, the short term loan industry has a high default rate. So, the main reason the interest is so high is due to the high default rate. I’m not even going to go into how they’re people and groups out there that treat scamming of payday lenders as their job or the cost of the heaps and heaps of regulations that are piled upon payday lenders, the cost of employees, etc.

I myself wish that everyone would repay their loan back, that there was not an over-regulation of the industry and that there where not so many people trying to scam the lenders and therefore the interest rates could be much much much lower, but it is what it is. Only serving a clientele that has bad credit, lives payday to payday and has no other options when it comes to getting a loan in an emergency is NOT a reason to make them illegal, over-regulate them or even rail against them. If you don’t use short-term loans and are against them then just be thankful and hopeful you never get yourself into a situation where you need one of these loans as they may not be available some day because of your efforts to tarnish them.

If you’re facing a financial emergency and have no where else to turn then Green Leaf Loan Group will be here for you and help you get that loan. Simply click loan application to apply and we promise we will do our best to get you that loan at the lowest possible cost to you.

by “Ray West“