Planning a Summer Vacation? Online Payday Loans Can Help

It’s finally that time of year. The weather is warm. The sun is shining. The kids are out of school. You have vacation time to use. It’s time to plan a summer trip. Summer is the best time of year for a vacation with the family, and you don’t have to spend a lot to make it happen. With careful planning, and even tools like online payday loans, you can afford a great summer vacation that will provide you and your family with memories for years to come.

Start Planning Now and Use Online Payday Loans

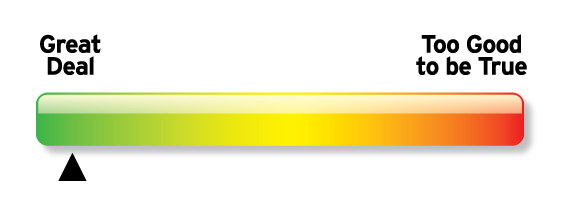

The most important way you can guarantee that you get an affordable, yet still enjoyable, summer trip this year is to plan well and plan ahead. With careful budgeting and research you can find some really great deals for all kinds of vacations. Start searching now and you’ll find that there are some travel deals available that make a trip a reality, even if you sometimes struggle with cash flow. As you plan your trip, make sure you consider all the expenses you’ll encounter. Your vacation will include more than just hotel, gas, and food. You may also need to pay for souvenirs, new clothes, and tickets to events or parks. As you add up the possible expenses, consider getting online payday loans to help you finance your trip or save up for it. Online payday loans are easy, affordable, and quick.

Here’s How You Can Get Online Payday Loans

When you find that great deal on a flight or a hotel package, you may think you have made your vacation dreams a reality. Then you realize you need to pay in advance to get that discount. If you don’t have the cash on hand to take advantage of the deal, consider getting online payday loans to help. All you need to do to apply for them is fill out an online application and provide information about what you earn from your full-time job. With this basic information, a lender can approve you almost instantly. Use the cash from your online payday loans to reserve that special travel deal and then repay your loan with your next paycheck. It’s that easy to get the cash you need to finance your dream summer vacation.