Three Mistakes to Avoid with Online Payday Loans

Online payday loans are great financing options, especially for anyone with bad or minimal credit or anyone who doesn’t need to borrow a huge chunk of money. Being debt-free is always ideal, but for most of us, borrowing is a reality. There will always be times when your paycheck doesn’t last long enough, when an unexpected expense comes up because of an emergency situation, or when any other financial need finds you turning to online payday loans for a little extra cash.

The Top Online Payday Loans Mistakes

We can get you that cash you sometimes need and we can get it to you quickly and with no hassle with our online payday loans. Of course, you should borrow wisely, but not everyone does. Here are some of the top mistakes people make, that you can avoid:

1. Not using online payday loans. Some people are afraid to use payday loans because they falsely believe they are too expensive or that payday lenders try to trick people into getting stuck in debt. This couldn’t be further from the truth. Our lenders are responsible and will help you get the money you need at an affordable rate.

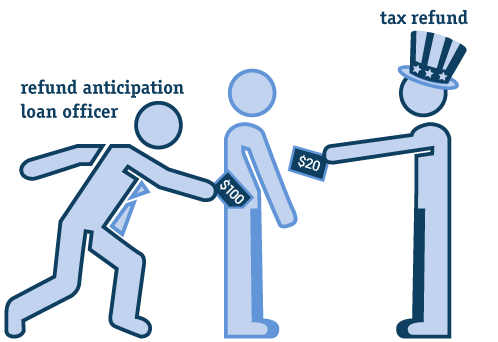

2. Borrowing more than you need. Borrowing money wisely means knowing your limits. Never take out more than you need or you run the risk of struggling to pay the loan back. We can offer line of credit loans in addition to standard online payday loans, so you never make this common mistake.

3. Carrying loans for too long. Payday loans are affordable because they are short-term. You should never carry one of these small loans for longer than one or two pay periods or you will end up paying too much interest.

Apply for Online Payday Loans Today

Our helpful lenders can get you started with online payday loans today. If you’ve never used this type of loan before, they can walk you through the terms and rates and help you feel comfortable with the process. To apply all you need to do is go online to fill out a simple application. We’ll have a lender contact you right away to help you take the next step. We have lenders available all hours of the day, so you won’t wait long to get your approval or to see the cash deposited in your account.