Why Get A Loan You Have To Budget To Repay, When You Could Get A Tax Anticipation Loan?

When you need extra cash and get approved for a loan, it’s a tremendous feeling of relief – and then you have to figure out how to pay it back. It’s always doable, but often at least a little uncomfortable in the short term. On the other hand, once a year we have the opportunity to file our income taxes and collect a refund of the amount we paid in that exceeds what we owed. Now, combine those two things and you come away with a Tax Anticipation Loan, a way to borrow the amount you expect to have refunded at tax time, receive it when you need it most, and repay the loan with your refund when it arrives, so it doesn’t have to affect your household budget. Depending on the timing of the loan it might be necessary to make room in the budget for payments initially, but when the refund arrives from the government you can then pay yourself back and restore your personal finances to normal.

Online Tax Anticipation Loans Don’t Require You To Prepare Your Taxes First

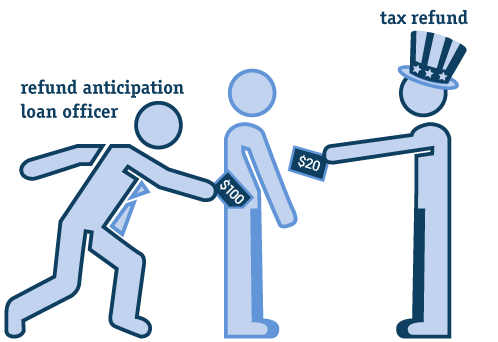

There are tax preparation services, national chains found in every city and town, that offer Tax Anticipation Loans, but those could hardly be more different from the online services such as IncomeTaxAdvances.com. First of all, the brick-and-mortar services are based on the premise of preparing your taxes for you for a fee. Online services do not provide that service – and do not require that you have your taxes done by anyone, even yourself, before providing a loan advance against the refund you anticipate receiving. They don’t require a copy of your return, or any proof of the amount you’ll be receiving – that’s all up to you.

All you need to do to be eligible for a Tax Anticipation Loan is be a legal adult, a US citizen with a steady job meeting the minimum income requirements, and have a bank account with direct deposit. You don’t even need good credit – the lenders don’t use your credit score as a factor in their decisions regarding approval, so you can have good, bad, or no credit at all and your chances won’t be affected.

Repayment of Online Tax Anticipation Loan Is A Nearly Foolproof Process

There’s nothing worse than realizing you’ve forgotten to make a bill payment and you’re going to get hit with a big late fee – and maybe even a negative report on your credit. Online Tax Anticipation Loans are set up to make sure that payments are always made automatically and on time, and that they don’t overdraw your checking account when they go through. The terms of the loan provided when you accept and sign off on it will include a schedule of payments to be drafted from the same bank account the funds are deposited to. These will happen on your paydays, to ensure that there are funds in the account and that you don’t incur any overdraft fees due to the payment. Fees and interest will be calculated into the amount you repay, which is another advantage over the advances provided by brick-and-mortar preparers who actually deduct them from the balance you receive in your original funding amount!