Income Tax loans are helping taxpayers get out of difficult financial situations

If you are worried about keeping your utilities on, avoiding overdraft fees, and paying your bills on time, you may benefit from one of our popular income tax loans services. Many hard-working Americans struggle with their finances on a daily basis. For some, tax season is the only time they can catch a break and get the extra money they need. However, depending on when a taxpayer files, he or she could wait weeks to receive an income tax refund. For some, that’s just too long to wait.

Can’t wait on the IRS any longer? Income Tax loans get taxpayers their cash in less than 24 hours

Income Tax loans are based on a taxpayer’s estimated income tax refund. This type of loan is sometimes called a income tax refund advance or refund anticipation loan. These income tax loans are very similar to pay day loans and/or cash advance loans. The main benefit of an income tax loan is the turnaround—income tax loans are directly deposited into a borrower’s account less than 24 hours after they applied.

Income Tax loans are quick, affordable, and convenient

Getting approved for an income tax loan is easy. As long as you’re expecting a return back from the IRS, you’re currently employed, and you’ve already filed or are ready to file your taxes, you can be instantly approved. Income Tax loans help thousands of Americans get their cash in a timely manner. You can get help, too.

Bigger isn’t always better, and this maxim holds true when it comes to payday cash advances. After all, if you take out a big cash advance, you’re responsible for paying back interest on every dollar. On the other hand, with a small payday cash advance, you have to pay much less interest, as the principal is lower, even if the interest rates are the same, and they will often be lower for smaller loans than big ones. You can see why it’s an advantage to borrow a smaller amount of money whenever possible.

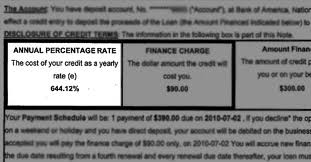

Bigger isn’t always better, and this maxim holds true when it comes to payday cash advances. After all, if you take out a big cash advance, you’re responsible for paying back interest on every dollar. On the other hand, with a small payday cash advance, you have to pay much less interest, as the principal is lower, even if the interest rates are the same, and they will often be lower for smaller loans than big ones. You can see why it’s an advantage to borrow a smaller amount of money whenever possible. Fees and interest rates are two of the most important things to examine in detail before deciding which small payday cash advance offer to accept. Any extension options are worth noting, just in case it becomes necessary to delay your repayment of the advance. A small payday cash advance can grow bigger if you extend since you’ll pay more for having the money longer!

Fees and interest rates are two of the most important things to examine in detail before deciding which small payday cash advance offer to accept. Any extension options are worth noting, just in case it becomes necessary to delay your repayment of the advance. A small payday cash advance can grow bigger if you extend since you’ll pay more for having the money longer! If you have found yourself short of cash and had a check that bounced because of lack of funds in your account, then the No Telecheck Payday Loans option may be exactly what you need. For those that have cash flow problems between paydays, the no telecheck payday loans option is a way to get the badly needed funds to cover emergencies that might have occured. Yes, there are some people that are unable to get payday loans, once they have bounced a check because a telecheck is ran. However, it is possible to find no telecheck payday loan lenders, if you know where to look.

If you have found yourself short of cash and had a check that bounced because of lack of funds in your account, then the No Telecheck Payday Loans option may be exactly what you need. For those that have cash flow problems between paydays, the no telecheck payday loans option is a way to get the badly needed funds to cover emergencies that might have occured. Yes, there are some people that are unable to get payday loans, once they have bounced a check because a telecheck is ran. However, it is possible to find no telecheck payday loan lenders, if you know where to look. With the ease and convenience of the Internet and your personal computer, it is possible to find no telecheck payday loans that can put the cash in your bank account within a matter of hours. For those that have had past credit problems, including a bounced check, then the no telecheck payday loans and no telecheck cash advances can relieve the stress and anxiety associated with an emergency, when you haven’t got the cash to cover the expense. While other forms of short-term borrowing might involve running a telecheck, you can get the money you need with the no telecheck payday loans and no telecheck cash advances and not need to go through the embarrassment a bounced check can cause.

With the ease and convenience of the Internet and your personal computer, it is possible to find no telecheck payday loans that can put the cash in your bank account within a matter of hours. For those that have had past credit problems, including a bounced check, then the no telecheck payday loans and no telecheck cash advances can relieve the stress and anxiety associated with an emergency, when you haven’t got the cash to cover the expense. While other forms of short-term borrowing might involve running a telecheck, you can get the money you need with the no telecheck payday loans and no telecheck cash advances and not need to go through the embarrassment a bounced check can cause.